Last week Senate Republicans passed their budget proposal on a straight party line vote. The Republican plan eliminates local school levies and imposes a $5.6 billion, statewide property tax. Currently, our existing local property tax funds can be spent only in the school districts of the voters who approved them and only on education. The Republicans’ statewide property tax funds, by contrast, can be used for education (or for any other use, for that matter) anywhere in the state. This isn’t an education plan so much as a property tax plan by another name.

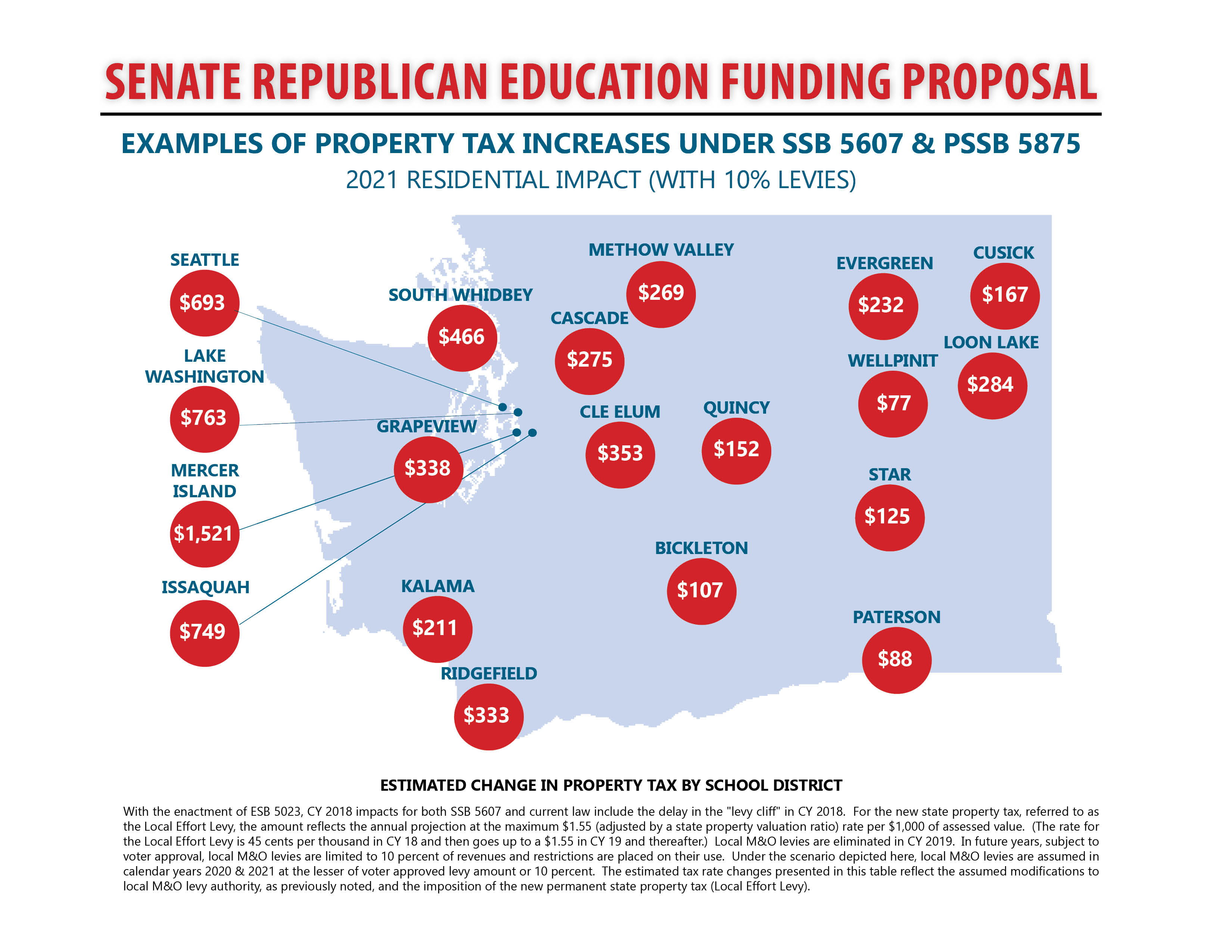

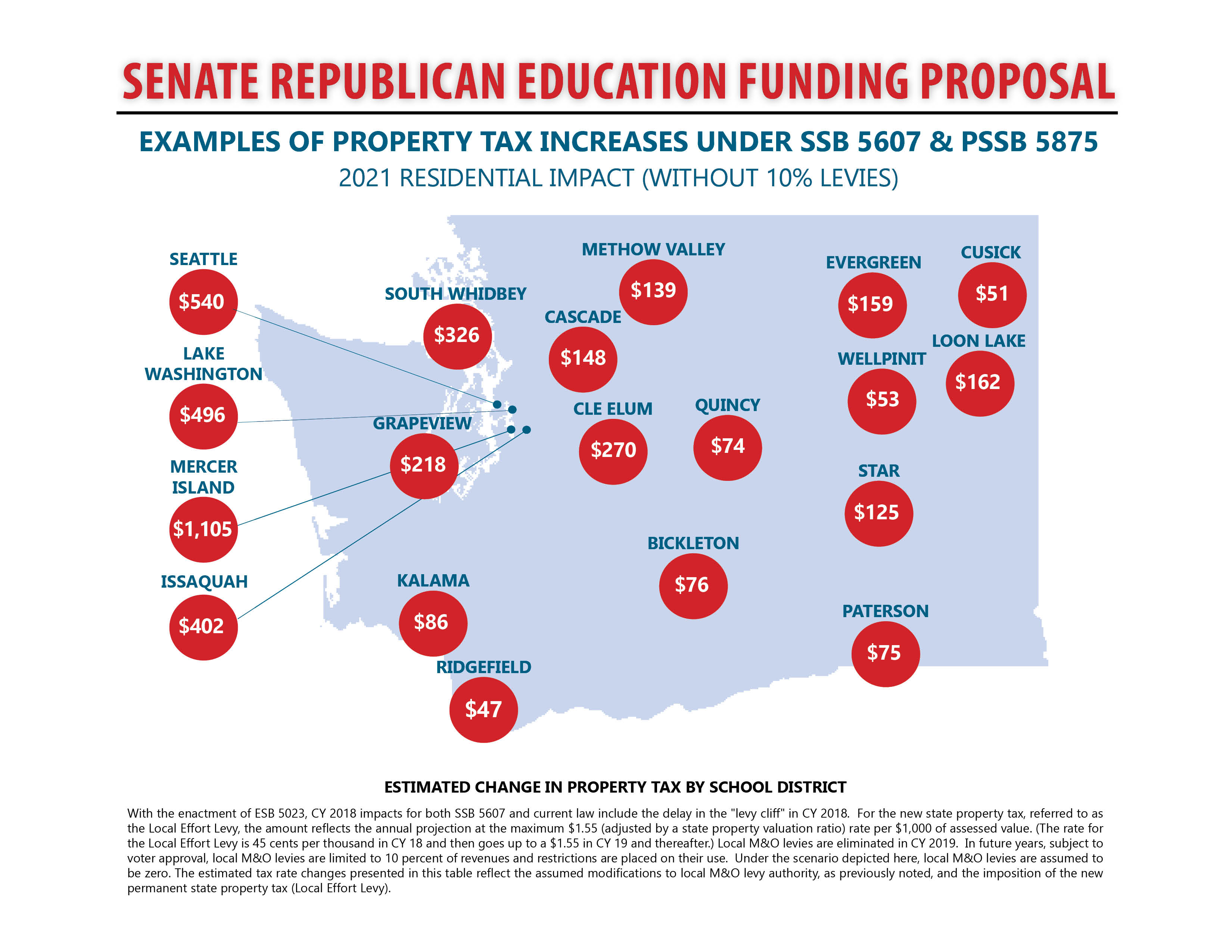

The tax shift has expensive consequences for many of our communities. By 2021, homeowners across the state would pay hundreds more per year in property taxes while receiving extremely modest increases in education funding, or in some cases fewer resources than they currently receive. That’s not good for our students’ education and it’s not fair to homeowners.

Below are examples of tax increases throughout the state under the Senate Republican K-12 plan, Senate Bills 5607 and 5875. They reflect two options – one if taxpayers vote to approve levy capacity at the 10 percent limit and another if voters reject 10 percent levy capacity. As you will see there are tax increases associated with both choices. Click here to view the impacts for all districts and view data we used to create the maps.